Workforce Development

|

1 on 1 SessionsWorkforce Development -

|

NJ State Industry SectorsNew Jersey's major industries include:

· Chemicals · Electrical and electronic equipment · Textiles · Food · Toys · Sporting goods · Stone, glass, and clay products · Educational services · Construction · Accommodation and food services · Health care and social assistance New Jersey's largest industries include: New Jersey's Economy: The Top Industries Driving GDP Growth New Jersey's largest industries include financial services, transportation and logistics, and life sciences. While the technology industry in New Jersey is shrinking, the healthcare and life sciences industry continues to grow due to the concentration of institutions and demand driven by an older population. Investopedia NY State Industry SectorsThe Office of Strategic Workforce Development has identified the following as statewide high-growth target industry sectors:

Advancing Careers for Low-Income Families

The Federal Reserve Bank of Atlanta has developed four tools designed to provide information about how benefits change with income gains. "One significant barrier occurs when career advancement puts a family above the income eligibility threshold for public assistance programs. Due to the gradual or sudden loss of these programs, career advancement opportunities can result in the family being worse off (a benefits cliff) or no better off (a benefits plateau) than before the wage increase." These free tools can be used by employers, educators, career centers & counselors, CBOs, and more! Please share this opportunity with your colleagues and leaders in Human Resources, Talent Acquisition, Compensation & Benefits, and Administration & Finance! CENTER FOR WORKFORCE AND ECONOMIC OPPORTUNITYSkills-based Approaches for Finding Talent and Diversifying the Workforce: Six Lessons from Employers

Sergio Galeano and Katherine Townsend Kiernan November 17, 2022 2022-03 https://doi.org/10.29338/wc2022-03 Download the full text of this paper (559 KB) Discontent, Occupational Change, and the Roles Workers Are Leaving amid the Great Resignation

Nye Hodge September 28, 2022 2022-02 https://doi.org/10.29338/wc2022-02 Download the full text of this paper (179 KB) Women's Experience in the Labor Market: Pandemic Reflections

Sarah Miller June 2, 2022 2022-01 https://doi.org/10.29338/wc2022-01 Download the full text of this paper (185 KB) Career Ladder Identifier and Financial Forecaster (CLIFF)

Some working families experience financial barriers to economic mobility. One significant barrier occurs when career advancement puts a family above the income eligibility threshold for public assistance programs. Due to the gradual or sudden loss of these programs, career advancement opportunities can result in the family being financially worse off (a benefits cliff) or no better off (a benefits plateau) than before the wage increase. This loss of means-tested public assistance is an effective marginal tax rate on income gains. High effective marginal tax rates mean that some workers have a financial disincentive to invest in their own human capital and advance from lower-wage work to jobs that lead to economic self-sufficiency. Current Grant Funding Opportunities

Workforce Pathways for Youth - FOA-ETA-22-07 The Workforce Pathways for Youth demonstration grants support national out-of-school time (OST) organizations that serve historically underserved and marginalized youth ages 14 to 21. These grants will place an emphasis on age-appropriate workforce readiness programming to expand job training and workforce pathways for youth, including soft skill development, career exploration, job readiness and certification, summer jobs, year-round job opportunities, and apprenticeships. Funding will also support partnerships between workforce boards and youth serving organizations. Prospective Applicant Webinar

Apprenticeship Building America (ABA) Grant Program - FOA-ETA-22-06 This Funding Opportunity Announcement solicits applications for the Apprenticeship Building America (ABA) grant program. This FOA supports a coordinated, national investment strategy that aims to strengthen and modernize the Registered Apprenticeship Program (RAP) system, centered on equity and promotes Registered Apprenticeship as a workforce development solution. Applicants have the opportunity to apply for funding across four grant categories: (1) State Apprenticeship System Building and Modernization; (2) Expansion of RAP Opportunities for Youth; (3) Ensuring Equitable RAP Pathways Through Pre-Apprenticeship Leading to RAP Enrollment and Equity Partnerships; and (4) Registered Apprenticeship Hubs. The ABA grant program builds on the Department’s previous and ongoing efforts to expand and modernize Registered Apprenticeship through expanding the number of programs and apprentices, diversifying the industries that utilize Registered Apprenticeship, and increasing access to and completion of RAPs for underrepresented populations and underserved communities. Prospective Applicant Webinar Recording Prospective Applicant Webinar Transcript

Prospective Applicant Webinar

Growth Opportunities - FOA-ETA-22-03Through the Growth Opportunities grant program, the Department will introduce and prepare justice-involved youth and young adults for the world of work through placement into paid work experiences. These grants focus on youth and young adults most impacted by community violence, particularly in areas of concentrated crime and poverty as well as communities that have recently experienced significant unrest. This program contributes to the Biden-Harris Administration’s comprehensive strategy to combat gun violence and other violent crime, in part, with preventative measures that are proven to reduce violent crime and support public safety and community well-being. The goals of the grant are to: help youth and young adults to increase their conflict resolution skills and develop strategies to prevent and avoid violence; introduce and prepare youth for the world of work; help youth identify career interests, attain relevant skills and gain work experience; and provide income to youth, to start them on the path of earning living wages and obtaining high quality jobs and careers. Prospective Applicant Webinar

Strengthening Community Colleges Training Grant - FOA-ETA-22-02This Funding Opportunity Announcement (FOA) solicits applications for the second round of Strengthening Community Colleges Training Grants (or SCC2). For the purposes of this FOA, this training initiative has two parts: the standard program grants will be referred to as SCC2 Program Grants and the additional evaluation funds will be referred to as Additional SCC2 Evaluation Funding. The purpose of this program is to address two inter-related needs: 1) to increase the capacity and responsiveness of community colleges to address identified equity gaps, and 2) to meet the skill development needs of employers in in-demand industries and career pathways, as well as the skill development needs of underserved and underrepresented workers. Ultimately, these grants should build the capacity of community colleges to address identified equity gaps and meet the skill development needs of employers in in-demand industries and career pathways leading to quality jobs. These efforts will yield sustainable systems-level changes in education and training through collaboration between community colleges, employers and the public workforce development system that align education and training, work experiences, and industry-recognized credentials that lead to career growth. Prospective Applicant Webinar

|

Smart Cities booksGrants Awarded in 2023

Grants Awarded

Grants Awarded

Grants Awarded in 2022

About Our Office

|

Workforce development from the organizational centric perspective is defined as training programs that provide existing and potential workers with the skills to complete tasks needed by employers to let the organizations stay competitive in a global marketplace.

Workforce development prioritizes human development and boosts morale, retention, and productivity. Organizations that enact workforce development programs view employees as assets, not just headcount to perform a specific task or purpose.

Workforce development helps to identify current trends and forecast future workforce structures that can help to meet service delivery requirements. This in turn can lead to the development and implementation of skills sets to raise labor productivity and increase social inclusion.

The economic development system is designed to encourage business and job growth, while the workforce development system works to ensure individuals have the education, skills, and training needed to obtain jobs

In a large organizations, this effort crosses into several of the different “silos” of responsibility within the organization. Sitting in an area of responsibilities between, Human Resources, Social Impact and Government relations, it is also the face of the organization to the public and the complex .government workforce and economic development agencies, which in NJ are local, county and state, and it also interacts with the Federal Government agencies.

To be most effective this area needs to have regular interaction and support from each of these areas to be most effective, it also should function as the center of excellence/ subject matter experts to include the full organization to become educated and to learn how to implement in all their daily work.

Like most innovative and work of purpose it needs the complete support and avocation of the top leadership of the organization.

Workforce development prioritizes human development and boosts morale, retention, and productivity. Organizations that enact workforce development programs view employees as assets, not just headcount to perform a specific task or purpose.

Workforce development helps to identify current trends and forecast future workforce structures that can help to meet service delivery requirements. This in turn can lead to the development and implementation of skills sets to raise labor productivity and increase social inclusion.

The economic development system is designed to encourage business and job growth, while the workforce development system works to ensure individuals have the education, skills, and training needed to obtain jobs

In a large organizations, this effort crosses into several of the different “silos” of responsibility within the organization. Sitting in an area of responsibilities between, Human Resources, Social Impact and Government relations, it is also the face of the organization to the public and the complex .government workforce and economic development agencies, which in NJ are local, county and state, and it also interacts with the Federal Government agencies.

To be most effective this area needs to have regular interaction and support from each of these areas to be most effective, it also should function as the center of excellence/ subject matter experts to include the full organization to become educated and to learn how to implement in all their daily work.

Like most innovative and work of purpose it needs the complete support and avocation of the top leadership of the organization.

Workforce of the future The competing forces shaping 2030 PWC

Center Of Excellence

Center of Excellence model

The Center Of Excellence Model: Purpose, Intent and Value Proposition. COEs have evolved to have different missions, some more tactical and some more strategic. Their three primary mission areas are: Run the Business, Grow the Business, and Transform the Business.

The Center Of Excellence Model: Purpose, Intent and Value Proposition. COEs have evolved to have different missions, some more tactical and some more strategic. Their three primary mission areas are: Run the Business, Grow the Business, and Transform the Business.

Everything You Need to Know About Centers of Excellence - Access to Expertise is More Important Than Ever

Center of Excellence Definition: What is a COE?

Center of Excellence Implementation

How the Catalant Platform Enables COE Success

Today’s enterprises face unprecedented pressure from more nimble startups, volatile market trends, and a global health crisis. Those that thrive will be hyper-focused on driving value in the long term, innovating and adapting to changing conditions faster than their competitors.

However, most organizations simply aren’t built to succeed this way. A recent PwC Survey found that leaders are extremely concerned about their organization’s rate of innovation. In fact, 44% of CEO’s felt their speed of technological change was insufficient, and 32% did not possess the availability of key skills. KPMG found that 57% of CEOs are concerned that their organizations don’t have innovative processes to respond to rapid disruption, and in a separate study PwC discovered that 61% of companies say the solution to reaching strategic goals is collaborating more across functions, paired with faster decision-making.

It is clear that organizations are failing to innovate rapidly because they lack fast access to expertise. Gartner learned in one study that 75% of organizations will fail to achieve the full potential of the internet of things (IoT) due to lack of access to data scientists and another 80% of companies that expected to employ AI by 2019 failed for similar reasons. Meanwhile, McKinsey found that only 20% of companies have maximized their potential and achieved advanced analytics at scale, even while most companies understand the importance.

Even beyond leading-edge technologies, access to expertise remains a challenge for enterprise leaders. In 2018, McKinsey found that organizations that move top talent to high-priority initiatives quickly were 2.2X more likely to return shareholder value than their slower counterparts.

Centers of Excellence Streamline Access to Expertise

Centers of Excellence were designed to improve the reach of critical expertise throughout the organization, agnostic of geographical location or business unit. For functions like IT or Operations, centers of excellence already have a strong track record of success.

Gartner shows that 95% of organizations that establish a Cloud Center of Excellence will deliver measurable cloud transformational success through 2021. McKinsey learned that 60% of top-performing companies in advanced analytics have a “center of gravity” to drive their analytics efforts forward, and in a separate study Garter found that 50% of organizations with more than three AI projects will establish a Center of Excellence for AI by 2022.

So what is a Center of Excellence, how can you stand one up in your organization, and what are the benefits they deliver to the bottom line? Read on to learn everything you need to know about Centers of Excellence.

Center of Excellence Definition: What is a COE?A COE (Center of Excellence) is a centralized unit of dedicated people with a mission to streamline access to scarce, high-demand capabilities for rapid execution across the business. This group hones expertise in a specific subject area, standardizes best practices for wide-scale adoption, and provides thought leadership & direction in their area of expertise.

According to Gartner, COEs exist to “concentrat(e) existing expertise and resources in a discipline or capability to attain and sustain world-class performance and value.” These virtual or physical centers combine learning and oversight in a specific area, driving the organization to shift across multiple disciplines together.

For instance, you may have the heads of various marketing-related functions from across different product lines gather in a COE around implementing best-in-class social customer care for their customers, with shared customer history, multiple types of customized content, and more relevant content production. Therefore, the COE would focus on providing training, best practices, and resources for all of these different teams, while also gathering the data and learnings from all of the teams to create a positive feedback loop.

Six Requirements for a Successful Center of ExcellenceIn order to successfully stand up a COE, organizations must take a multi-part approach to development and implementation. In working with clients that have effectively deployed COEs throughout the organization we have identified the six requirements necessary for long-term COE success:

The Center Of Excellence Model: Purpose, Intent and Value Proposition COEs have evolved to have different missions, some more tactical and some more strategic. Their three primary mission areas are: Run the Business, Grow the Business, and Transform the Business.

Center of Excellence Definition: What is a COE?

Center of Excellence Implementation

How the Catalant Platform Enables COE Success

Today’s enterprises face unprecedented pressure from more nimble startups, volatile market trends, and a global health crisis. Those that thrive will be hyper-focused on driving value in the long term, innovating and adapting to changing conditions faster than their competitors.

However, most organizations simply aren’t built to succeed this way. A recent PwC Survey found that leaders are extremely concerned about their organization’s rate of innovation. In fact, 44% of CEO’s felt their speed of technological change was insufficient, and 32% did not possess the availability of key skills. KPMG found that 57% of CEOs are concerned that their organizations don’t have innovative processes to respond to rapid disruption, and in a separate study PwC discovered that 61% of companies say the solution to reaching strategic goals is collaborating more across functions, paired with faster decision-making.

It is clear that organizations are failing to innovate rapidly because they lack fast access to expertise. Gartner learned in one study that 75% of organizations will fail to achieve the full potential of the internet of things (IoT) due to lack of access to data scientists and another 80% of companies that expected to employ AI by 2019 failed for similar reasons. Meanwhile, McKinsey found that only 20% of companies have maximized their potential and achieved advanced analytics at scale, even while most companies understand the importance.

Even beyond leading-edge technologies, access to expertise remains a challenge for enterprise leaders. In 2018, McKinsey found that organizations that move top talent to high-priority initiatives quickly were 2.2X more likely to return shareholder value than their slower counterparts.

Centers of Excellence Streamline Access to Expertise

Centers of Excellence were designed to improve the reach of critical expertise throughout the organization, agnostic of geographical location or business unit. For functions like IT or Operations, centers of excellence already have a strong track record of success.

Gartner shows that 95% of organizations that establish a Cloud Center of Excellence will deliver measurable cloud transformational success through 2021. McKinsey learned that 60% of top-performing companies in advanced analytics have a “center of gravity” to drive their analytics efforts forward, and in a separate study Garter found that 50% of organizations with more than three AI projects will establish a Center of Excellence for AI by 2022.

So what is a Center of Excellence, how can you stand one up in your organization, and what are the benefits they deliver to the bottom line? Read on to learn everything you need to know about Centers of Excellence.

Center of Excellence Definition: What is a COE?A COE (Center of Excellence) is a centralized unit of dedicated people with a mission to streamline access to scarce, high-demand capabilities for rapid execution across the business. This group hones expertise in a specific subject area, standardizes best practices for wide-scale adoption, and provides thought leadership & direction in their area of expertise.

According to Gartner, COEs exist to “concentrat(e) existing expertise and resources in a discipline or capability to attain and sustain world-class performance and value.” These virtual or physical centers combine learning and oversight in a specific area, driving the organization to shift across multiple disciplines together.

For instance, you may have the heads of various marketing-related functions from across different product lines gather in a COE around implementing best-in-class social customer care for their customers, with shared customer history, multiple types of customized content, and more relevant content production. Therefore, the COE would focus on providing training, best practices, and resources for all of these different teams, while also gathering the data and learnings from all of the teams to create a positive feedback loop.

Six Requirements for a Successful Center of ExcellenceIn order to successfully stand up a COE, organizations must take a multi-part approach to development and implementation. In working with clients that have effectively deployed COEs throughout the organization we have identified the six requirements necessary for long-term COE success:

- Strategy-Work Alignment & Prioritization

- Standardization of Execution Paths

- Effective Resource Management

- Value Management, Capacity Planning & Coordination Across Teams

- Demand Management, Risk Mitigation & Continuous Improvement

- Centralized Tracking, Auditing, & Reporting to Enterprise Management

- Shared Services Center/Shared Services Organization

- Global Business Services/Multifunctional Shared Services

- Global Insourced Center

- Global Shared Services Organization

- Center of Excellence (COE)

- Competency Center/Global Competency Center

- Capability Center

The Center Of Excellence Model: Purpose, Intent and Value Proposition COEs have evolved to have different missions, some more tactical and some more strategic. Their three primary mission areas are: Run the Business, Grow the Business, and Transform the Business.

- Run the Business: Run the Business COEs are focused on enterprise efficiency and driving bottom-line impact. These efficiencies can be found in reducing administrative transaction costs or enhancing operational decision support. Examples with the Finance unit include A/P, A/R, expense reporting, and tax accounting. Within HR these can be payroll or benefits and for IT they can include service desks, network infrastructure, and ops.

- Grow the Business: The shared services of a Grow the Business COE affect change in enterprise effectiveness, working to make productivity improvements. They will be tasked with improving enterprise competitiveness and cost optimization, as well as optimizing internal service delivery. These types of COEs can take the form of integrated business services, analytics services, or application development. App development for ERP and other specialty competency centers would be another example, as well as internal consulting organizations.

- Transform the Business: A Transform the Business COE looks at enterprise transformation through strategic contribution and alignment. They will drive innovation at the business as well as uncovering new strategic capabilities, markets, products, and/or business models. These COEs manifest as innovation centers or specialized R&D groups.

- Internal Consulting

- Continuous Improvement

- Operational Excellence

- Supply Chain

- Quality Assurance

- Business Analytics

- Artificial Intelligence (AI)

- Robotic Process Automation (RPA)

- Internet of Things (IoT)

- Advanced Digital

- Finance and Accounting

- HR

- Agile Development

Industry Sectors News:

|

The United States is a world economic powerhouse with the largest nominal GDP in the world, valued at 18.46 trillion dollars which translate to 22% of the world’s nominal GDP. The economy of the United States is divided into three broad categories including the service sector, the manufacturing sector, and the agricultural sector.

1. Real Estate, Renting, and Leasing Real Estate, renting, and leasing constitutes the largest sector of the United States’ economy with the GDP value added of $1.898 trillion accounting for 13% of the national GDP. The sector contributes to the economy in two fronts; the first being through consumer spending through rent and payment of household utilities, and the other being through residential investment which encompasses the construction of new housing units, broker fees, and residential remodeling. Also known as the housing sector, the industry plays an integral role in the US economy and the industry’s impact was best displayed during the 2008 recession where a nationwide decline in home prices triggered America’s worst economic recession in the 21st century. The housing sector also plays a critical role in employment with over 1.9 million people working in the real estate, renting and leasing industry. 2. State And Local Government The State and Local Government have a combined GDP value added of $1.336 trillion to become the second largest GDP contributor representing 9% of the total US GDP. Government spending is classified into two components government investment and government final consumption expenditure. Government investment is defined as the government spending used to finance projects with future or long-term benefits such as spending on research as well as spending on infrastructure. Government final consumption, on the other hand, is the government’s spending on items for direct consumption. State and local government spending are usually financed through taxation or domestic and international borrowing. 3. Finance and Insurance The Finance and Insurance sector is another top GDP contributor in the United States with the industry having a GDP value added of $1.159 trillion which is equivalent to 8% of the total GDP. The Finance and Insurance industry is made up of four distinct sectors which include insurance carriers, credit intermediation and Federal Reserve banks, commodity contracts and securities, and trusts and funds and other financial vehicles. The growth of the finance and insurance industry is critical to the US economy as it helps in the facilitation of US exports. The industry is also estimated to directly employ over 5 million people in the United States which is equivalent to 4% of the nation’s total employment. 4. Health and Social Care The Health and Social Care industry in the country has a GDP value added of $1.136 trillion and represents 8% of the national GDP. Healthcare, in particular, was a key component of the two sectors with America's spending on healthcare per capita being the largest in the world at $8,608. Increasing obesity and non-communicable diseases such as cancer saw Americans spending more on curative, rehabilitative, and preventative care. 5. Durable Manufacturing Durable Manufacturing is classified as the manufacturing sector engaged in the production of durable products such as computers, automobiles, firearms, sports equipment, house appliances, and aircraft which are characterized by long durations between purchases and are usually rentable. The durable manufacturing industry in the United States has a GDP value added of $910 billion which represents 6% of the national GDP. The sector is highly volatile and is affected by local and international factors such as global oil prices as well as the performance of the US dollar on international money markets. The durable manufacturing industry plays a significant role in employment in the US economy with over 349,000 of Americans being either directly or indirectly employed in the industry. 6. Retail Trade The retail trade industry in the United States has a GDP value added of $905 billion which is equivalent to 6% of the total GDP. The industry encompasses the retailing process which is the final stage in the distribution of commodities to the final consumer. The retail industry features fixed store retailers which are characterized by walk-in by customers who purchase merchandise for household or personal consumption. The retail industry is the largest employer in the United States economy with the sector being responsible for 10% of the total employment in the country. Data from the National Retail Federation shows that the industry accounts directly or indirectly for over 15 million jobs. The sector also features online retailers such as Amazon and eBay who make millions of dollars in sales each day. 7. Wholesale Trade Wholesale Trade involves the bulk distribution of commodities from producers to retailers or bulk consumers such as institutions and other wholesalers. Wholesalers are characterized by not spending on advertising targeted to the general public, and they do not have their own premises. Similarly, they are not designed for walk-in customers. The Wholesale industry in the United States has a GDP value added of $845 billion which is equivalent to 6% of the total GDP. The industry is also a significant employer with over 5.7 million people or 4% of total employment in the US being employed in wholesale trade. 8. Nondurable Manufacturing The non-durable manufacturing industry is involved in the production of nondurable commodities, which may be defined as all products with a lifespan of less than three years and include gasoline, electricity, and clothing among others. Non-durable manufacturing is an important economic pillar in the United States and has a GDP value added of $821 billion which translates to 6% of the national GDP. While the non-durable manufacturing sector is less valuable than durable manufacturing, it employs way more people than durable manufacturing accounting for 4.4 million jobs compared to 349,000 jobs from durable manufacturing. 9. Federal Government The Federal Government comes in ninth position with a GDP value added of $658 billion which accounts for 5% of the total GDP. The Federal Government is a key employer in the economy and employs about 2.795 million Americans who are employed by the Federal Government. Healthcare, social security, and education take up the lion’s share of Federal Government investments accounting 25%, 24%, and 15% of the annual investments respectively. 10. InformationThe Information industry encompasses companies and institutions which engage in the production, transmission, processing, storing, and selling of information which includes media companies, data processing companies, law firms, and telephone companies among others. The information industry is a key pillar of the US economy and has GDP value added of $646 billion which is equivalent to 4% of the total GDP. The sector is responsible for the employment of 2% of the total labor force in the United States totaling about 2.7 million jobs.

The U.S. Chamber of Commerce Foundation (USCCF) is engaging employers and their partners across the country in developing a new demand-driven approach—talent pipeline management—to close the skills gap. Through extending lessons learned from innovations in supply chain management, this is a call for employers to play a new and expanded leadership role as “end-customers” of education and workforce partnerships.

This white paper begins by examining the challenge and need for a “demand-driven” system. From there, it introduces supply chain management and explores key lessons that inform how employers can improve their partnerships with education and workforce providers. Next, the paper identifies three foundational principles for a new talent pipeline management system and concludes by highlighting implications for key stakeholders, including employers, education and workforce providers, students and workers, and policymakers. Diversity in RecruitingHuman resources professionals think recruiting for diversity is important and design their efforts around that goal. The benefits that a diverse workforce can bring are many.

A diverse and inclusive company — in which employees can contribute to the success of the organization as their “authentic selves”— is a company better positioned to be more responsive to an increasingly diverse pool of customers and markets. Greater workplace diversity can help overcome talent shortages and stimulate innovation, motivate staff, and build loyalty among clients. The question is how to get there. Cast Your Net Far and Wide Recruiting for diversity is more than trying out a new job fair or visiting a different campus. It requires developing a strategic plan. Consider starting with these best practices. Review That Job Description Again. If it includes unnecessary and restrictive qualifications — those that don’t truly matter to getting the job done — then you’ve already limited your pool of candidates. Tailor Your Look.Design your brochures, website and other recruiting materials to reflect the diversity you want. If potential candidates can see themselves, then they can more easily see themselves working for you. Think Ahead to Retention. Roll out diversity training to staff, including leadership, before implementing your recruiting plan. (We all might need a little help in learning how to accept differences, as well as new goals.) Offer training and mentorship to these new employees early on. You hired them for their talent. Make sure they have the tools to succeed… and grow your company! Use Your Best Storytellers. Pitch your company at career fairs and other events by using your most ardent and compelling champions who also have a natural ease in relating to others — including those who are different from them. Career seekers are looking for organizations that are serious about using and grooming their talents. If they see people who look like them or project a welcoming attitude, you’ve got their ear from the get-go. Be in the Right Place. Ensure your company has a presence in:

What we’ve seen is that companies that recruit the best talent, regardless of any real or perceived differences, tend to be the ones that thrive. Wouldn’t it be a shame if you missed out on hiring remarkable employees with fresh thinking because you failed to look in the all the right places? Current Employment Statistics (Establishment Data):

Table B-1. Employees on nonfarm payrolls by industry sector and selected industry detail, Seasonally adjusted The workers worth more than the firm

The labor shortage in Eastern Europe is so chronic, workers are considered more valuable than any other business asset, reports Reuters. Some companies are even "acquihiring" — making acquisitions just so they can snap up the workforce and the skills and expertise that come with it. A Eurostat survey found 83% of industrial companies in Hungary were limited by a lack of workers in the third quarter, with that figure at 50% in Poland and 44% in the Czech Republic. Related Content

HEALTHCARE INDUSTRY RESOURCES |

Industry Sector Talent Pipelines:Apprenticeship: Industry-Specific Resource Pages

Apprenticeship has been used by businesses to recruit, train, and retain a highly skilled and productive workforce for more than 75 years in the U.S. Today, employers are taking advantage of this flexible training strategy to operate apprenticeships in over 1,000 occupations, that span a diverse set of industries. The following pages offer industry-specific tools, successful program examples, and other resources that can be used to help start and expand Registered Apprenticeship programs in each sector. | ||||||

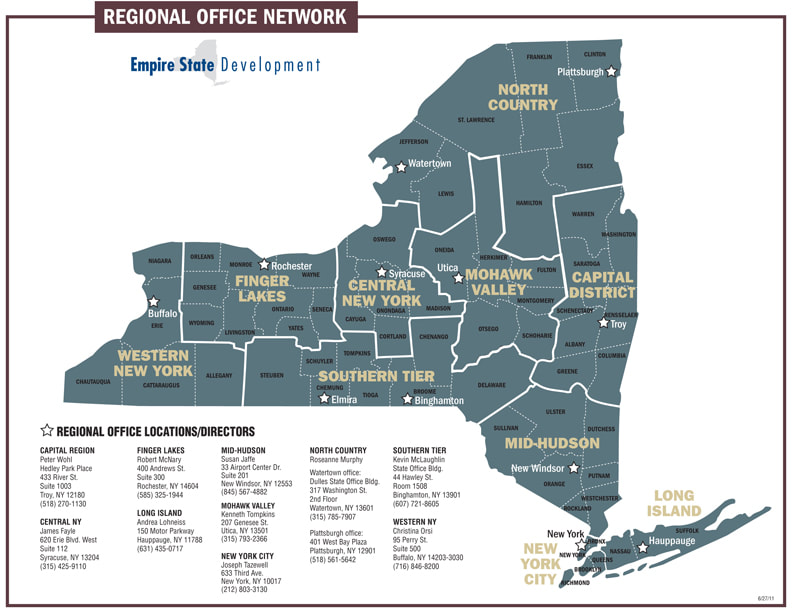

NY State

The state of New York has the third-largest economy in the United States, trailing only Texas and California. New York's economy is so large, it would rank as the 15th or 16th largest economy in the world if it were its own country; the exact ranking depends on the source.

Its signature metropolitan center, New York City, is the single largest regional urban economy in the country. New York City is the leading job hub for banking, finance and communication in the U.S. New York is also a major manufacturing center and shipping port, and it has a thriving technological sector. There are more books, magazines and newspapers published in New York than in any other state in the country. In short, the leading industries in New York are not just driving the state's economy; they are leading the charge on a national and global scale.

1. Financial Services

The financial services sector is synonymous with Wall Street, which is located in Manhattan. The New York Stock Exchange (NYSE), founded in 1817, is likely the most influential securities exchange in the world. This sector does not lead New York in terms of total employees or total productive wealth, but few question it is the most influential. It is also one of the most potentially lucrative; financial professionals in New York earn an average of four times the amount of the average New Yorker.

Financial services are highly concentrated in New York City. According to the New York Bureau of Labor Market Information, more than 90% of jobs in securities, commodities and other investments are located in downtown New York City. Nearly every such job outside of downtown is located in Long Island or the Hudson Valley region. All told, there are more than 330,000 financial services workers in New York.

2. Health Care

New York is home to nearly 20 million people, which means there is a lot of demand for health care services. The New York Department of Labor indicates there are more employees in the "Health Care and Social Assistance" industry than any other. Moreover, the Labor Department anticipates high job growth in the sector.

Unlike financial services, however, the median wage for health care jobs in New York falls below state averages. And while many large New York-based health care firms have made substantial profits since the passing of the Affordable Care Act of 2010, the industry does not demonstrate the same cyclical influence on the state economy as Wall Street. Health care industry growth in New York is fueled, in part, by programs such as PILOT Health Tech NYC, the Community Health Clinic Expansion Program and the Bio & Health Tech Entrepreneurship Lab NYC.

3. Professional and Technical Services

As of 2015, there were an estimated 647,800 New Yorkers working in professional and technical services. This broad field includes a great number of different professional groups, such as lawyers, accountants, mechanics and marketers, who share similar characteristics.

These are the professionals who make daily life possible for individuals and businesses, and who work primarily in supplemental roles to other, more notable sectors. For this reason, this group of professions is highly sensitive to economic cycles; unlike financial services, which lead economic trends in many cases, professional and technical services are beholden to the success of other industries.

According to Department of Labor research, the professional, scientific and technical services group is the only significant industry that displayed all of the following: faster-than-average job growth rate; faster-than-average salary growth rate; and an average weekly wage above the state average.

4. Retail Trade

Retail trade also includes a large number of subindustries, such as food and beverage, clothing retailers, electronics retailers, auto retailers and everything else that comes to mind when invoking images of Fifth Avenue. As in finance and manufacturing, New York retailers and their marketing advisers are major trendsetters in the national industry.

According to the Retail Council of New York State, there are greater than 800,000 workers in more than 75,000 New York retail businesses. Many of these jobs are spread throughout the greater New York City area, particularly Manhattan and Jefferson County.

This is another cyclical industry that tends to be very hard hit during economic recessions, though some defensive industries, such as food, do not necessarily see the same fluctuations. Like professional services, retail trade is often a trailing sector and is usually a byproduct rather than a cause of a healthy New York economy.

5. Manufacturing

New York exports a wide variety of manufactured goods to other states and foreign countries. The manufacturing sector is a leader in railroad rolling stock, as many of the earliest railroads were financed or founded in New York; garments, as New York City is the fashion capital of the U.S.; elevator parts; glass; and many other products.

As many cheaper and lower-paying manufacturing jobs continue to relocate overseas, New York has seen a corresponding rise in technical manufacturing. This includes computer products, mobile devices, video games, 3-D printing and general software engineering tools. These jobs tend to pay well above the average state wage.

The great manufacturing hub of New York is located just east of Newark and Staten Island in what locals refer to as the Five Boroughs. After more than a decade of bleeding jobs away from New York's high-tax and high-cost environment, an entrepreneurial boom led to net gains in manufacturing in 2014. In the years between 1997 and 2013, New York City alone saw almost 125,000 manufacturing jobs disappear.

6. Educational Services

Though not typically thought of as a leading industry, the educational sector in New York nonetheless has a substantial impact on the state and its residents, and in attracting new talent that eventually enters the New York business scene.

There are hundreds of thousands of teachers, teachers' assistants, professors, tutors, child care workers, educational agencies and other education sector employees in the state. Many of them are public employees, as the government is the largest employer in the state, though there is also a healthy private education market.

This sector tends to grow at an average rate with total employment levels and total population levels. New York has seen a large uptick in college attendees, both young and old, over the 21st century, and an increasing number of new employees in other New York sectors were educated in the state.

Its signature metropolitan center, New York City, is the single largest regional urban economy in the country. New York City is the leading job hub for banking, finance and communication in the U.S. New York is also a major manufacturing center and shipping port, and it has a thriving technological sector. There are more books, magazines and newspapers published in New York than in any other state in the country. In short, the leading industries in New York are not just driving the state's economy; they are leading the charge on a national and global scale.

1. Financial Services

The financial services sector is synonymous with Wall Street, which is located in Manhattan. The New York Stock Exchange (NYSE), founded in 1817, is likely the most influential securities exchange in the world. This sector does not lead New York in terms of total employees or total productive wealth, but few question it is the most influential. It is also one of the most potentially lucrative; financial professionals in New York earn an average of four times the amount of the average New Yorker.

Financial services are highly concentrated in New York City. According to the New York Bureau of Labor Market Information, more than 90% of jobs in securities, commodities and other investments are located in downtown New York City. Nearly every such job outside of downtown is located in Long Island or the Hudson Valley region. All told, there are more than 330,000 financial services workers in New York.

2. Health Care

New York is home to nearly 20 million people, which means there is a lot of demand for health care services. The New York Department of Labor indicates there are more employees in the "Health Care and Social Assistance" industry than any other. Moreover, the Labor Department anticipates high job growth in the sector.

Unlike financial services, however, the median wage for health care jobs in New York falls below state averages. And while many large New York-based health care firms have made substantial profits since the passing of the Affordable Care Act of 2010, the industry does not demonstrate the same cyclical influence on the state economy as Wall Street. Health care industry growth in New York is fueled, in part, by programs such as PILOT Health Tech NYC, the Community Health Clinic Expansion Program and the Bio & Health Tech Entrepreneurship Lab NYC.

3. Professional and Technical Services

As of 2015, there were an estimated 647,800 New Yorkers working in professional and technical services. This broad field includes a great number of different professional groups, such as lawyers, accountants, mechanics and marketers, who share similar characteristics.

These are the professionals who make daily life possible for individuals and businesses, and who work primarily in supplemental roles to other, more notable sectors. For this reason, this group of professions is highly sensitive to economic cycles; unlike financial services, which lead economic trends in many cases, professional and technical services are beholden to the success of other industries.

According to Department of Labor research, the professional, scientific and technical services group is the only significant industry that displayed all of the following: faster-than-average job growth rate; faster-than-average salary growth rate; and an average weekly wage above the state average.

4. Retail Trade

Retail trade also includes a large number of subindustries, such as food and beverage, clothing retailers, electronics retailers, auto retailers and everything else that comes to mind when invoking images of Fifth Avenue. As in finance and manufacturing, New York retailers and their marketing advisers are major trendsetters in the national industry.

According to the Retail Council of New York State, there are greater than 800,000 workers in more than 75,000 New York retail businesses. Many of these jobs are spread throughout the greater New York City area, particularly Manhattan and Jefferson County.

This is another cyclical industry that tends to be very hard hit during economic recessions, though some defensive industries, such as food, do not necessarily see the same fluctuations. Like professional services, retail trade is often a trailing sector and is usually a byproduct rather than a cause of a healthy New York economy.

5. Manufacturing

New York exports a wide variety of manufactured goods to other states and foreign countries. The manufacturing sector is a leader in railroad rolling stock, as many of the earliest railroads were financed or founded in New York; garments, as New York City is the fashion capital of the U.S.; elevator parts; glass; and many other products.

As many cheaper and lower-paying manufacturing jobs continue to relocate overseas, New York has seen a corresponding rise in technical manufacturing. This includes computer products, mobile devices, video games, 3-D printing and general software engineering tools. These jobs tend to pay well above the average state wage.

The great manufacturing hub of New York is located just east of Newark and Staten Island in what locals refer to as the Five Boroughs. After more than a decade of bleeding jobs away from New York's high-tax and high-cost environment, an entrepreneurial boom led to net gains in manufacturing in 2014. In the years between 1997 and 2013, New York City alone saw almost 125,000 manufacturing jobs disappear.

6. Educational Services

Though not typically thought of as a leading industry, the educational sector in New York nonetheless has a substantial impact on the state and its residents, and in attracting new talent that eventually enters the New York business scene.

There are hundreds of thousands of teachers, teachers' assistants, professors, tutors, child care workers, educational agencies and other education sector employees in the state. Many of them are public employees, as the government is the largest employer in the state, though there is also a healthy private education market.

This sector tends to grow at an average rate with total employment levels and total population levels. New York has seen a large uptick in college attendees, both young and old, over the 21st century, and an increasing number of new employees in other New York sectors were educated in the state.

New Jersey

Invest in WorkD -Economic Development

Meadowlands Regional ChamberBergen CountyCarlstadt

East Rutherford Hasbrouck Heights Little Ferry Lyndhurst Moonachie North Arlington Ridgefield Rutherford South Hackensack Teterboro Wood-Ridge Hudson County Jersey City Kearny North Bergen Secaucus Transportation, Distribution, Logistics

Retail/Hospitality

Financial Services

Life Sciences

Construction / Utilities

G – Multi county Associations –

H - Educational

Bergen

4 Year Colleges and Universities NJCC - 19 Community Colleges I - Technology and e-Learning

J - K-12 leadership

K - Multi County CBOs

Related Links

USDOL – ETA USDOL Workforce3One GSETA National Skills Coalition National Governors Association Workforce Issues NASWA NAWB NAWDP Areas of PracticeA turning point is a pivotal point where things change direction. At Maher & Maher, our business is to create turning points for your organization through:

Industries We ServeWe have successfully served the following industries for 25 years: CentralSouthNew Jersey's seven Talent Development Centers promote partnerships between key industries and the state’s colleges and universities. They serve as "centers of excellence" for providing industry specific workforce training and skill development in Advanced Manufacturing, Construction & Utilities, Financial Services, Health Care, Retail, Hospitality & Tourism, and Transportation, Logistics & Distribution. The Talent Development Centers:

MEMBER COLLEGES

1 Atlantic Cape CC 2 Bergen CC 3 Brookdale CC 4 Burlington County College 5 Camden County College 6 Cumberland County College 7 Essex County College 8 Gloucester County College 9 Hudson County CC 10 Mercer County CC 11 Middlesex County College 12 County College of Morris 13 Ocean County College 14 Passaic County CC 15 Raritan Valley CC 16 Salem Community College 17 Sussex County CC 18 Union County College 19 Warren County CC |

Governor Murphy, Lieutenant Governor Oliver Announce the Release of Final Transition Committee ReportsReports were released by the following Transition committees:

The reports are available at

http://nj.gov/governor/news/reports/approved/reports_archive.shtml

Articles of Interest

NJ Industry Sector stratetyNew Jersey's Talent Networks Use the links below

| ||||||||||||||||||||||||||||||||||||||||||||||||

| tld.pdf | |

| File Size: | 3271 kb |

| File Type: | |

Health Care Industry Sector Report

| healthcare.pdf | |

| File Size: | 4663 kb |

| File Type: | |

| construction-utilities.pdf | |

| File Size: | 8405 kb |

| File Type: | |

Technology Industry Sector Report

| technology.pdf | |

| File Size: | 4183 kb |

| File Type: | |

Retail Hospitality & Tourism Industry Sector Report

| lhr.pdf | |

| File Size: | 3596 kb |

| File Type: | |

Chambers of Commerce

New Jersey Population by County

ank County Population

1 Bergen County 939,151

2 Middlesex County 837,073

3 Essex County 796,914

4 Hudson County 677,983

5 Monmouth County 625,846

6 Ocean County 592,497

7 Union County 555,630

8 Camden County 510,150

9 Passaic County 507,945

10 Morris County 498,423

11 Burlington County 449,284

12 Mercer County 371,023

13 Somerset County 333,751

14 Gloucester County 292,330

15 Atlantic County 270,991

16 Cumberland County 153,797

17 Sussex County 142,522

18 Hunterdon County 124,676

19 Warren County 106,617

20 Cape May County 94,430

21 Salem County 63,436

1 Bergen County 939,151

2 Middlesex County 837,073

3 Essex County 796,914

4 Hudson County 677,983

5 Monmouth County 625,846

6 Ocean County 592,497

7 Union County 555,630

8 Camden County 510,150

9 Passaic County 507,945

10 Morris County 498,423

11 Burlington County 449,284

12 Mercer County 371,023

13 Somerset County 333,751

14 Gloucester County 292,330

15 Atlantic County 270,991

16 Cumberland County 153,797

17 Sussex County 142,522

18 Hunterdon County 124,676

19 Warren County 106,617

20 Cape May County 94,430

21 Salem County 63,436

- Daily news covering commercial banking, credit unions, payments, technology, risk, regulation & policy

- Daily news covering the biotech and pharma industries, drug development, the FDA, commercialization, gene therapy and M&A

- Reporting, Q&As, and research covering accounting & tax, corporate finance, human capital, risk & compliance, strategy, technology

- Daily news covering financial strategy & operations, reporting, risk management, compliance, treasury, leadership

- Daily news covering IT strategy, cloud computing, cybersecurity, big data, AI & future tech, software

- Daily news on commercial and residential construction, economy, infrastructure, labor & safety, regulations

- Daily news covering cyber strategy, breaches, vulnerability, cyberattacks, threats, regulation

- Daily news covering food manufacturing, ingredients, packaging, beverages, food tech, sustainability

- Daily news covering center store, e-commerce, alternative grocery formats, fresh food, technology and foodservice

- Daily news covering talent, learning, compensation & benefits, diversity & inclusion, compliance, HR management

- Daily news covering hospitals, health insurance, payers, health IT, medical groups, telehealth

- Daily news covering online learning, policy, leadership, student success, enrollment

- Daily news covering leadership, school models, technology, curriculum, professional development, pre-K & early childhood

- Daily news covering legal operations, human capital management, legal tech, intellectual property, contract law, employment law

- Daily news covering brand strategy, mobile marketing, creative, social media, video, agencies, ad tech, CMOs

- Daily news covering medical devices, clinical trials, device manufacturing, diagnostics, R&D, digital health, imaging, policy & regulation

- Daily news covering mulit family housing, rents, operations, transactions, capital, development, tech, regulation

- Daily news covering payments in retail, banking, and restaurants, regulations & policy, risk, technology, B2B

- Reporting, Q&As, and profiles covering biotech, commercialization, leadership, manufacturing, patient, pharma, policy & regulation, R&D

- Community discussions about accounting, budgeting & forecasting, cash management, credit & capital, FP&A, risk management, tax

- Daily news covering consumer trends, delivery, restaurant tech, marketing, M&A, labor & policy, food service ops

- Daily news covering retail technology, marketing, DTC, operations, store concepts, shopping trends

- Daily news covering energy, buildings & design, climate & resilience, environment, governance, transportation, tech & data

- Daily news covering social media platforms, algorithms, influencer marketing, advertising, digital strategy

- Daily news covering regulation, freight, logistics, operations, procurement, technology

- Daily news covering technology, operations, regulatory, safety, equipment, workforce, infrastructure

- Daily news covering energy generation, transmission & distribution, grid reliability, electrification, load management, renewables, storage

- Daily news covering recycling, landfill, collections, organics, zero waste, workforce, environmental, social and governance