|

Small Business depends on networking as much as any other size business, and it becomes even more essential to get the help to grow.

Building upon the same principles of Neighbors-helping-Neighbors USA successful model for job seekers helping each other as peers, We launched Business-helping-Business USA where business owners can meet and share best practices and form alliances that could help them grow faster than attempting to go at it alone would accomplish. We continue to face in a very difficult local economy which requires a much stronger effort by small business to be successful than it did in the past economy. How to Develop Strategic Business Partnerships That Flourish Long-TermAs a small business owner, you recognize the immense value of forging collaborations with other businesses. These partnerships are pivotal for mutual growth and success. Yet, the path to successful collaborations is filled with nuances and demands strategic planning and astute considerations. This guide, courtesy of Neighbors-Helping-Neighbors USA, offers essential insights and straightforward strategies to navigate these business alliances effectively.

Diligent Partner Evaluation You must diligently research potential partners before commencing a collaboration. Delve into their business history, assess their reputation in the market, and evaluate how their business goals align with yours. Understanding their strengths and weaknesses will enable you to gauge the potential synergy between your businesses. This level of insight is instrumental in making informed decisions and setting the stage for a successful partnership. Optimal Business Structure Selection When it comes to partnering, the structure of your business plays a crucial role. Consider the benefits of forming an LLC (e.g., limited liability, tax advantages, less paperwork, flexibility). This structure provides you with significant legal and financial advantages and positions your business for more streamlined collaborative ventures. Researching and reading reviews of formation services will guide you in choosing a cost-effective and efficient way to establish this structure. Cultural Compatibility Assessment Ensuring a cultural match with your business partner is as critical as aligning business goals. Seek partners whose values, missions, and operational styles resonate with yours. This harmony in culture and ethos is a cornerstone for smooth collaboration. It fosters an environment of mutual respect and understanding, which is crucial for navigating challenges and leveraging opportunities together. Clarification of Partnership Goals Clarity in partnership objectives, roles, and expectations is non-negotiable. Document these elements meticulously. This practice serves as a reference point throughout the partnership and helps prevent potential misunderstandings. Clear, well-defined objectives ensure that both parties are on the same page, working cohesively towards common goals. Legal Agreement Formulation When establishing business partnerships, opting for PDFs is the optimal choice for creating and formalizing legal agreements. PDFs serve as a versatile file format, preserving document formatting and making them an excellent option for sharing across various platforms and devices. They offer ease of editing, facilitating efficient updates as your collaboration progresses. This method guarantees that all involved parties possess a transparent and uniform comprehension of the agreement terms, making it the best option for drafting agreements. Effective Communication Strategies Regular and transparent communication is the lifeline of a successful business partnership. Establish robust channels for consistent and effective communication. This openness fosters trust, allows for timely updates, and ensures swift resolution of issues. Remember that in business collaborations, the quality of communication can often determine the quality of the outcome. Resource Management and Sharing When entering a collaboration, it's imperative to define how resources will be shared and managed clearly. Whether it's financial investment, assets, or workforce, a transparent and fair resource allocation strategy is key. This clarity prevents future conflicts and ensures a balanced investment from all parties, leading to a more productive and equitable partnership. Strategic Exit Planning Even with the best plans, sometimes collaborations do not unfold as expected. Hence, having a predefined exit strategy is essential. This strategy should outline the process for an amicable disengagement, safeguarding the interests of all parties involved. Planning for such eventualities ensures that the partnership can be dissolved with minimal disruption and conflict, should the need arise. The Bottom Line Your strategic planning, comprehensive research, and deep understanding of partnership dynamics are crucial when navigating business collaborations. As a small business owner, adhering to these guiding principles empowers you to lead your collaborative ventures to triumph and notable expansion. Your approach and mindset in these alliances are pivotal in transforming them into a dynamic force for your business's success. Mastering the art of collaboration will unlock new opportunities and foster substantial growth for your business. Each successful partnership you engage in can be a stepping stone to greater achievements in your entrepreneurial journey. If you enjoyed this article, you can find more helpful content at NHNUSA.org!

Andrea Giraldo

|

John R. Fugazzie

LinkedIn Profile Founder Neighbors-helping-Neighbors USA www.helping-brands.com Cell: 551.204.5667 www.johnrfugazzie.com | ||||||

Division of Revenue and Enterprise Services

Uniform Certification Service

Help

Who to contact for help?

What is a Small Business Enterprise (SBE) Registration?

Can I compete for a Small Business Set Aside contract if I get my SBE registration after the bid opening date?

My company was considered ineligible to be a SBE under the old rules and regulations. Do the new rules and regulations take into consideration new industries or sizes?

What is NJSAVI?

What is the cost to perform SBE filings?

When will I receive my SBE Certificate?

I forgot to download my SBE Certificate, can I still access it?

What happens if I decide not to continue with SBE Filings and close my browser?

What if my PC crashes during a transaction?

How long can I leave my browser and shopping cart open with no activity without losing any information?

What is the BRC Number?

What is New Jersey Business ID?

What is the possible status that a business may have in the NJSAVI System?

How can I get the SBE Certificate?

What is the difference between the Registration and Renewal process?

When am I due for filing the Annual Verifications?

What happens if I fail to submit the Annual Verification during the Verification Window?

What is a “Trading As” means?

How is the Gross Revenue Category determined?

Where can I find the commodity and construction codes?

What are the factors determining the Gross Revenue Category applicable for the SBE filing?

Can I setup users on my account?

How do I set-up users on my account?

How does the “Invite New User” functionality work?

Why do I need to set-up users?

How do I remove a user from my account?

How do I go about ensuring that information in my record is updated?

Where do I get information on new bids from State agencies, universities and authorities?

Can I get automatic notification of new bid opportunities?

What is the statutory definition of a Minority?

Who to contact for help?

If you have questions about The Small Business Enterprise (SBE) Program, rules and regulations, or your application(s), contact the NJ Division of Revenue & Enterprise Services Small Business Registration & M/WBE Certification Services Unit

Phone: 609-292-2146 E-mail: https://www.state.nj.us/treasury/revenue/revgencode.shtml

If you are having technical difficulty, contact the New Jersey e-Government Services Help Desk Phone: 609-292-2146 or Contact Us

Uniform Certification Service

Help

Who to contact for help?

What is a Small Business Enterprise (SBE) Registration?

Can I compete for a Small Business Set Aside contract if I get my SBE registration after the bid opening date?

My company was considered ineligible to be a SBE under the old rules and regulations. Do the new rules and regulations take into consideration new industries or sizes?

What is NJSAVI?

What is the cost to perform SBE filings?

When will I receive my SBE Certificate?

I forgot to download my SBE Certificate, can I still access it?

What happens if I decide not to continue with SBE Filings and close my browser?

What if my PC crashes during a transaction?

How long can I leave my browser and shopping cart open with no activity without losing any information?

What is the BRC Number?

What is New Jersey Business ID?

What is the possible status that a business may have in the NJSAVI System?

How can I get the SBE Certificate?

What is the difference between the Registration and Renewal process?

When am I due for filing the Annual Verifications?

What happens if I fail to submit the Annual Verification during the Verification Window?

What is a “Trading As” means?

How is the Gross Revenue Category determined?

Where can I find the commodity and construction codes?

What are the factors determining the Gross Revenue Category applicable for the SBE filing?

Can I setup users on my account?

How do I set-up users on my account?

How does the “Invite New User” functionality work?

Why do I need to set-up users?

How do I remove a user from my account?

How do I go about ensuring that information in my record is updated?

Where do I get information on new bids from State agencies, universities and authorities?

Can I get automatic notification of new bid opportunities?

What is the statutory definition of a Minority?

Who to contact for help?

If you have questions about The Small Business Enterprise (SBE) Program, rules and regulations, or your application(s), contact the NJ Division of Revenue & Enterprise Services Small Business Registration & M/WBE Certification Services Unit

Phone: 609-292-2146 E-mail: https://www.state.nj.us/treasury/revenue/revgencode.shtml

If you are having technical difficulty, contact the New Jersey e-Government Services Help Desk Phone: 609-292-2146 or Contact Us

Businesses Started by Older Workers

Studies show that 50+ can be the best age to start a business:

If you need examples, role models, inspiration - that’s out there, too:

Studies show that 50+ can be the best age to start a business:

- Research indicates that more mature people have more innovation potential than a 25-year-old.

- A new report says that 3 in every 10 entrepreneurs are over the age of 50 today.

- The number of entrepreneurs over age 50 is surging in the United States, having increased by 50 percent since 2007, according to a new research report.

If you need examples, role models, inspiration - that’s out there, too:

Restaurant Revitalization Fund

The American Rescue Plan Act established the Restaurant Revitalization Fund (RRF) to provide funding to help restaurants and other eligible businesses keep their doors open. This program will provide restaurants with funding equal to their pandemic-related revenue loss up to $10 million per business and no more than $5 million per physical location. Recipients are not required to repay the funding as long as funds are used for eligible uses no later than March 11, 2023.

Eligible entities who have experienced pandemic-related revenue loss include:

Funds may be used for specific expenses including:

Apply through SBA-recognized Point of Sale Restaurant Partners or directly via SBA in a forthcoming online application portal.

Registration with SAM.gov is not required. DUNS or CAGE identifiers are also not required.

If you would like to prepare your application, view the sample application form. You will be able to complete SBA Form 3172 online. Please do not submit RRF forms to SBA at this time.

Additional documentation required:

For an initial 21-day period, the SBA will prioritize awarding grants for small business concerns owned and controlled by women, veterans, or socially and economically disadvantaged small business concerns.

To learn more click here.

The American Rescue Plan Act established the Restaurant Revitalization Fund (RRF) to provide funding to help restaurants and other eligible businesses keep their doors open. This program will provide restaurants with funding equal to their pandemic-related revenue loss up to $10 million per business and no more than $5 million per physical location. Recipients are not required to repay the funding as long as funds are used for eligible uses no later than March 11, 2023.

Eligible entities who have experienced pandemic-related revenue loss include:

- Restaurants

- Food stands, food trucks, food carts

- Caterers

- Bars, saloons, lounges, taverns

- Snack and nonalcoholic beverage bars

- Bakeries (onsite sales to the public comprise at least 33% of gross receipts)

- Brewpubs, tasting rooms, taprooms (onsite sales to the public comprise at least 33% of gross receipts)

- Breweries and/or microbreweries (onsite sales to the public comprise at least 33% of gross receipts)

- Wineries and distilleries (onsite sales to the public comprise at least 33% of gross receipts)

- Inns (onsite sales of food and beverage to the public comprise at least 33% of gross receipts)

- Licensed facilities or premises of a beverage alcohol producer where the public may taste, sample, or purchase products

Funds may be used for specific expenses including:

- Business payroll costs (including sick leave)

- Payments on any business mortgage obligation

- Business rent payments (note: this does not include prepayment of rent)

- Business debt service (both principal and interest; note: this does not include any prepayment of principal or interest)

- Business utility payments

- Business maintenance expenses

- Construction of outdoor seating

- Business supplies (including protective equipment and cleaning materials)

- Business food and beverage expenses (including raw materials)

- Covered supplier costs

- Business operating expenses

Apply through SBA-recognized Point of Sale Restaurant Partners or directly via SBA in a forthcoming online application portal.

Registration with SAM.gov is not required. DUNS or CAGE identifiers are also not required.

If you would like to prepare your application, view the sample application form. You will be able to complete SBA Form 3172 online. Please do not submit RRF forms to SBA at this time.

Additional documentation required:

- Verification for Tax Information: IRS Form 4506-T, completed and signed by Applicant. Completion of this form digitally on the SBA platform will satisfy this requirement.

- Gross Receipts Documentation: Any of the following documents demonstrating gross receipts and, if applicable, eligible expenses

- Business tax returns (IRS Form 1120 or IRS 1120-S)

- IRS Forms 1040 Schedule C; IRS Forms 1040 Schedule F

- For a partnership: partnership’s IRS Form 1065 (including K-1s)

- Bank statements

- Externally or internally prepared financial statements such as Income Statements or Profit and Loss Statements

- Point of sale report(s), including IRS Form 1099-K

For an initial 21-day period, the SBA will prioritize awarding grants for small business concerns owned and controlled by women, veterans, or socially and economically disadvantaged small business concerns.

To learn more click here.

Dear Colleagues,

Thank you again for registering for yesterday’s web briefing, “COVID-19 and Government Assistance for New Jersey Non-Profits,” presented by the Office of United States Senator Cory Booker in partnership with the Center for Non-Profits. We thank Senator Booker, Kaitlin McGuinness and the rest of his team for making the session possible. We are especially grateful to Senator Booker for taking the time to share his insights on the call, and for fighting for New Jersey, for non-profits and for the communities we serve.

We would also like to thank Alfred Titone, New Jersey District Director, U.S. Small Business Administration; Elizabeth Limbrick and John Costello, Senior Advisors, New Jersey Economic Development Authority, for generously sharing their time and expertise.

1) Recording Link, Slides, and Referenced Documents

· The full webinar recording is available HERE.

· The slides used in the presentation are attached and are also posted on the Center for Non-Profits’ website at https://njnonprofits.org/Slides_SenBookerWebBriefing04092020.pdf.

· A Coronavirus Pandemic Resource Guide for New Jerseyans, compiled by the Senator’s staff, is attached and available online at www.booker.senate.gov/coronavirus

· SBA FAQs for faith-based organizations - attached

2) SBA and NJEDA

· U.S. Small Business Administration (SBA)

www.sba.gov/funding-programs/loans/coronavirus-relief-options

· U.S. Department of Treasury site: https://home.treasury.gov/policy-issues/top-priorities/cares-act/assistance-for-small-businesses

· Disaster application Page (NOT PPP): https://covid19relief.sba.gov/#/

· Disaster Assistance by Phone: 1-800-659-2955 (TTY/TDD: 1-800-877-8339)

By email: [email protected]

· State of NJ (including NJEDA and links to the Eligibility Wizard)

https://cv.business.nj.gov

3) Survey Reports – The Covid-19 Crisis and New Jersey’s Non-Profit Community

· Report #1 (March 13-17, 2020)

· Report #2 (April 3-7, 2020)

We are grateful to the Council of New Jersey Grantmakers for partnering with us on both surveys.

4) COVID-19 hubs

· State of NJ main Coronavirus Hub: https://covid19.nj.gov/

· Center for Non-Profits COVID-19 Resource Page: https://njnonprofits.org/COVID-19.html

5) Private relief funds, philanthropic response:

· Council of NJ Grantmakers (NJ-focused): www.cnjg.org/nj-focused-response-funds

· Candid. (U.S. and beyond): https://candid.org/explore-issues/coronavirus

· (Also check the Center’s page above.)

6) COMPLETE YOUR 2020 CENSUS AND SPREAD THE WORD.

One of the best ways to help get more resources for NJ is to complete your 2020 Census. https://my2020census.gov/

Stay Connected – Sign up for the Center’s email and connect with us on Twitter, Facebook, LinkedIn and Instagram for the latest news and updates.

Consider Joining the Center as a Member – If you’re a non-profit in New Jersey, consider becoming a member of the Center for Non-Profits. Membership supports the Center’s work, to advocate for the non-profit community, and to provide timely information, guidance and to connect non-profits with critical resources and with each other.

Finally, and above all, please stay safe and stay in touch.

Send us your questions, comments, concerns and suggestions. We are here for you, and ready to help however we can. Together we will make it through this very challenging time.

THANK YOU for everything you are doing to make our communities and state stronger.

With best wishes,

Linda

-------------------------------------------

Linda M. Czipo | President & CEO

Center for Non-Profits

3635 Quakerbridge Road, Suite 35 | Mercerville, NJ 08619

[email protected]

Thank you again for registering for yesterday’s web briefing, “COVID-19 and Government Assistance for New Jersey Non-Profits,” presented by the Office of United States Senator Cory Booker in partnership with the Center for Non-Profits. We thank Senator Booker, Kaitlin McGuinness and the rest of his team for making the session possible. We are especially grateful to Senator Booker for taking the time to share his insights on the call, and for fighting for New Jersey, for non-profits and for the communities we serve.

We would also like to thank Alfred Titone, New Jersey District Director, U.S. Small Business Administration; Elizabeth Limbrick and John Costello, Senior Advisors, New Jersey Economic Development Authority, for generously sharing their time and expertise.

1) Recording Link, Slides, and Referenced Documents

· The full webinar recording is available HERE.

· The slides used in the presentation are attached and are also posted on the Center for Non-Profits’ website at https://njnonprofits.org/Slides_SenBookerWebBriefing04092020.pdf.

· A Coronavirus Pandemic Resource Guide for New Jerseyans, compiled by the Senator’s staff, is attached and available online at www.booker.senate.gov/coronavirus

· SBA FAQs for faith-based organizations - attached

2) SBA and NJEDA

· U.S. Small Business Administration (SBA)

www.sba.gov/funding-programs/loans/coronavirus-relief-options

· U.S. Department of Treasury site: https://home.treasury.gov/policy-issues/top-priorities/cares-act/assistance-for-small-businesses

· Disaster application Page (NOT PPP): https://covid19relief.sba.gov/#/

· Disaster Assistance by Phone: 1-800-659-2955 (TTY/TDD: 1-800-877-8339)

By email: [email protected]

· State of NJ (including NJEDA and links to the Eligibility Wizard)

https://cv.business.nj.gov

3) Survey Reports – The Covid-19 Crisis and New Jersey’s Non-Profit Community

· Report #1 (March 13-17, 2020)

· Report #2 (April 3-7, 2020)

We are grateful to the Council of New Jersey Grantmakers for partnering with us on both surveys.

4) COVID-19 hubs

· State of NJ main Coronavirus Hub: https://covid19.nj.gov/

· Center for Non-Profits COVID-19 Resource Page: https://njnonprofits.org/COVID-19.html

5) Private relief funds, philanthropic response:

· Council of NJ Grantmakers (NJ-focused): www.cnjg.org/nj-focused-response-funds

· Candid. (U.S. and beyond): https://candid.org/explore-issues/coronavirus

· (Also check the Center’s page above.)

6) COMPLETE YOUR 2020 CENSUS AND SPREAD THE WORD.

One of the best ways to help get more resources for NJ is to complete your 2020 Census. https://my2020census.gov/

Stay Connected – Sign up for the Center’s email and connect with us on Twitter, Facebook, LinkedIn and Instagram for the latest news and updates.

Consider Joining the Center as a Member – If you’re a non-profit in New Jersey, consider becoming a member of the Center for Non-Profits. Membership supports the Center’s work, to advocate for the non-profit community, and to provide timely information, guidance and to connect non-profits with critical resources and with each other.

Finally, and above all, please stay safe and stay in touch.

Send us your questions, comments, concerns and suggestions. We are here for you, and ready to help however we can. Together we will make it through this very challenging time.

THANK YOU for everything you are doing to make our communities and state stronger.

With best wishes,

Linda

-------------------------------------------

Linda M. Czipo | President & CEO

Center for Non-Profits

3635 Quakerbridge Road, Suite 35 | Mercerville, NJ 08619

[email protected]

Guest Writers Articles

Image via Pexel

Shipping Mistakes to Avoid If You Want

to Be Successful Selling Online

Marcus Lansky

Founder, Abilitator.biz

[email protected]

NJBusiness.gov list of minority and local vendors

NJEDA’s COVID-19 NJ Business Initiatives Applications to Open Soon

We Can Help You Apply NOW

This week, the New Jersey Economic Development Authority (NJEDA) Board announced a package of initiatives that include grant and loan programs to help small- to medium-sized businesses, and non-profits who face economic hardship due to the COVID-19 pandemic.

Taken together, they will provide more than $75 million of state and private financial support, with the opportunity to grow to more than $100 million if additional philanthropic, state, and federal resources become available. The initiatives will support between 3,000 and 5,000 small and midsize enterprises and are meant to complement recently announced federal economic recovery initiatives.

Applications are anticipated to be opened during the week of March 30th.

If you need assistance in preparing your application, please contact us at (908) 295-5926 or email [email protected]

For more information, including full eligibility criteria, click on the program names below.

Additional details on the NJEDA’s new programs, including complete eligibility requirements are available here: https://cv.business.nj.gov

NOW is the time to apply for the assistance you need. For help applying, call 908-295-5926 or click here to email [email protected]

We Can Help You Apply NOW

This week, the New Jersey Economic Development Authority (NJEDA) Board announced a package of initiatives that include grant and loan programs to help small- to medium-sized businesses, and non-profits who face economic hardship due to the COVID-19 pandemic.

Taken together, they will provide more than $75 million of state and private financial support, with the opportunity to grow to more than $100 million if additional philanthropic, state, and federal resources become available. The initiatives will support between 3,000 and 5,000 small and midsize enterprises and are meant to complement recently announced federal economic recovery initiatives.

Applications are anticipated to be opened during the week of March 30th.

If you need assistance in preparing your application, please contact us at (908) 295-5926 or email [email protected]

For more information, including full eligibility criteria, click on the program names below.

- Small Business Emergency Assistance Grant Program – A $5 million program that will provide grants up to $5,000 to small businesses in retail, arts, entertainment, recreation, accommodation, food service, and other services – such as repair, maintenance, personal, and laundry services – to stabilize their operations and reduce the need for layoffs or furloughs.

- Small Business Emergency Assistance Loan Program – A $10 million program that will provide working capital loans of up to $100,000 to businesses with less than $5 million in revenues. Loans made through the program will have ten-year terms with zero percent for the first five years, then resetting to the EDA’s prevailing floor rate (capped at 3.00%) for the remaining five years.

- Community Development Finance Institution (CDFI) Emergency Loan Loss Reserve Fund – A $10 million capital reserve fund to take a first loss position on CDFI loans that provide low interest working capital to micro businesses. This will allow CDFIs to withstand loan defaults due to the outbreak, which will allow them to provide more loans at lower interest rates to microbusinesses affected by the outbreak.

- CDFI Emergency Assistance Grant Program – A $1.25 million program that will provide grants of up to $250,000 to CDFIs to scale operations or reduce interest rates for the duration of the outbreak.

- NJ Entrepreneur Support Program – A $5 million program that will encourage continued capital flows to new companies, often in the innovation economy, and temporarily support a shaky market by providing 80 percent loan guarantees for working capital loans to entrepreneurs.

- Small Business Emergency Assistance Guarantee Program – A $10 million program that will provide 50 percent guarantees on working capital loans and waive fees on loans made through institutions participating in the NJEDA’s existing Premier Lender or Premier CDFI programs.

- Emergency Technical Assistance Program – A $150,000 program that will support technical assistance to New Jersey-based companies applying for State and US Small Business Administration programs. The organizations contracted will be paid based on SBA application submissions supported by the technical assistance they provide.

Additional details on the NJEDA’s new programs, including complete eligibility requirements are available here: https://cv.business.nj.gov

NOW is the time to apply for the assistance you need. For help applying, call 908-295-5926 or click here to email [email protected]

Articles

How to help small businesses survive the coronavirus

Our economy continues to transition to a digital service based economy and trends in business and industry that helps those who also make this transition but harm those who are slow to adapt. This is a shifting consumer trend which will accelerate each month. The Corona Virus has only moved this process into high gear.

While many people have the desire and many of the skills to work for themselves and can create their own jobs to have more personal control over their lives and work.

There is higher risk in this approach and one must have the ability to handle failure as 1-20 ventures fail for one reason or another and the average entrepreneur has and average of three ventures before finding success.

While many people have the desire and many of the skills to work for themselves and can create their own jobs to have more personal control over their lives and work.

There is higher risk in this approach and one must have the ability to handle failure as 1-20 ventures fail for one reason or another and the average entrepreneur has and average of three ventures before finding success.

A good business plan guides you through each stage of starting, growing, expanding or recovering your business. It’s a way to think through the key elements of your business. This December, SBA celebrates National Write a Business Plan Month with tips and templates to help you create a plan for your business.

Learn more

Learn more

Free Course: How to Write a Business Plan SBA's free self-paced training course explains the importance of business planning, defines and describes the components of a business plan and provides access to sample plans and resources that can help you develop a business plan.

Launch the course

Launch the course

New Jersey Chamber of Commerce List

Business Planning Templates Use the templates below, then meet with a SCORE mentor for expert

|

Social Media Marketing for Business

Small Business NewsSmall business is BIG!

The 23 million small businesses in America account for 54% of all U.S. sales. Small businesses provide 55% of all jobs and 66% of all net new jobs since the 1970s. The 600,000 plus franchised small businesses in the U.S. account for 40% of all retail sales and provide jobs for some 8 million people. The small business sector in America occupies 30-50% of all commercial space, an estimated 20-34 billion square feet. Furthermore, the small business sector is growing rapidly. While corporate America has been "downsizing", the rate of small business "start-ups" has grown, and the rate for small business failures has declined. The number of small businesses in the United States has increased 49% since 1982. Since 1990, as big business eliminated 4 million jobs, small businesses added 8 million new jobs. The Entrepreneur’s Checklist: 7 Things You Need To Start A Business

|

Business Members

New York Entrepreneurship Centers

New Jersey University Entrepreneurship Centers

|

March 28-30: Startup Weekend New Jersey

NJ Meetups: NJ Tech, Princeton, Scarlet , NJ Entrepreneurs, Madison, Jersey Shore, MSU |

|

The Future Starts HereThe Maryland Center for Entrepreneurship (MCE) is an initiative of the Howard County Economic Development Authority.

The MCE provides a robust, interactive community of innovators, entrepreneurs, investors and advisors collaborating to successfully ignite innovation and launch high-growth, technology-based companies in an entrepreneurial ecosystem abundant with resources. |

Centrally located in Columbia, the MCE leverages its position in the heart of the Baltimore-Washington metropolitan corridor to deliver best in class resources and services. "Getting Shtuff Done""Getting Shtuff Done" is the tagline gsd@mce indicates. The priorities of the MCE are consistent with that of the HCEDA's goals of starting, growing, and attracting new companies. Specifically Building a Community, Connecting the Ecosystem, and Igniting Innovation |

The Top 50 Entrepreneurship Programs

| nyu_entrepreneur_handbook_2013-2014.pdf | |

| File Size: | 1222 kb |

| File Type: | |

Useful Links for Small Businesses

Web Resources Free:

Emerging Opportunities Web Resources Free:

Articles Free:

Books & ebooks

- The Kauffman Foundation Summary

- Foundation for Enterprise Development Summary

- Bootstrapping 101 Summary

- Edward Lowe Foundation Summary

- Business Owners Toolkit: Total Know-how for Small Business Summary

- US Small Business Administration Summary

- Principles of Entrepreneurship Summary

- StartupNation Summary

- The Entrepreneurship Education Resource Summary

- Wicked Start Summary

- Cayenne Consulting Entrepreneur's Library Summary

- "Natural-Born Entrepreneur - Lessons of a Serial Entrepreneur" Summary

- "A Litmus Test for Entrepreneurs" Summary

- "Want to be an Entrepreneur? (Part I)" Summary

- "Who wants to be an Entrepreneur? (Part II)" Summary

- "Growing Fast and Smart" Summary

- "Andy Grove: Lessons from an American Role Model"

- "The Questions Every Entrepreneur Must Answer" HU PIN Summary

- "A Test for the Fainthearted" HU PIN Summary

- "Skill vs. Luck in Entrepreneurship and Venture Capital: Evidence from Serial Entrepreneurs" HU PIN Summary

- Entrepreneur.com Summary

- FSB: Fortune Small Business Summary

- Inc Magazine Summary

- Wall Street Journal: Small Business News Summary

- International Journal of Entrepreneurial Behavior & Research HU PIN Summary

- Journal of Business Venturing HU PIN Summary

- Journal of Small Business Management HU PIN Summary

- Business Source Complete Summary

- New Business Ventures and the Entrepreneur Summary

- The Entrepreneurial Mindset: Strategies for Continuously Creating Opportunity in an Age of Uncertainty Summary

- Small Business Sourcebook Summary

- Harvard Business Review on Entrepreneurship Summary

- The Entrepreneurial Venture: Readings Summary

- Roadmap to Entrepreneurial Success: Powerful Strategies for Building a High-Profit Business Summary

- HOLLIS Catalog Summary

Emerging Opportunities Web Resources Free:

Articles Free:

- "Spot the Latest Trends" Summary

- "International Issues in Entrepreneurship" Summary

- "A Half-Century of Teaching Entrepreneurship"

Books & ebooks

Articles of interest

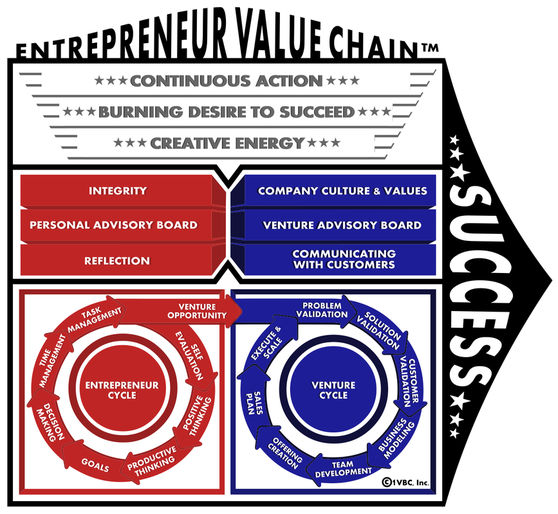

Entrepreneur Value Chain™: Turning Activities Into a Competitive Advantage for Entrepreneurs Every morning I arrive at work I have the pleasure of walking into a room full of aspiring entrepreneurs. The possibility in the room is palpable. The energy in the room is intense. Some strive to develop their entrepreneurial skill set. Some focus on conquering their next venture milestone. Most are struggling to turn a profit for the first time in their life. Entrepreneurs are an interesting bunch; they are refreshing to be around because they’re doers - my kind of people.

When I tell people I teach entrepreneurship, the majority respond with some variation of “how do you do that?” While I am still not convinced that entrepreneurship can be taught, I do know that success in an entrepreneurial endeavor requires interconnectedness between two critical forces. In entrepreneurship, it is the entrepreneur and the venture. These are not opposing forces, but complementary opposites, working together to create value. How do they do this? What does it take?

Most of my students drink the Michael Porter juice and get value chains. I like value chains too – really I like anything that uses visual representation to simplify something complex. So when the 1VBC team set out to create entrepreneur superstars – I naturally suggested a visual representation of what it takes to be a superstar. What it takes is the Entrepreneur Value Chain.

When I tell people I teach entrepreneurship, the majority respond with some variation of “how do you do that?” While I am still not convinced that entrepreneurship can be taught, I do know that success in an entrepreneurial endeavor requires interconnectedness between two critical forces. In entrepreneurship, it is the entrepreneur and the venture. These are not opposing forces, but complementary opposites, working together to create value. How do they do this? What does it take?

Most of my students drink the Michael Porter juice and get value chains. I like value chains too – really I like anything that uses visual representation to simplify something complex. So when the 1VBC team set out to create entrepreneur superstars – I naturally suggested a visual representation of what it takes to be a superstar. What it takes is the Entrepreneur Value Chain.

Becoming a superstar entrepreneur is a process with multiple moving parts that often occur in unison, so it lends itself perfectly to a value chain. Starting at the bottom, the primary activities are segmented into two main cycles: the Entrepreneur Cycle and the Venture Cycle. Working our way up the diagram, each cycle is sustained by a core group of characteristics. Then, the entire process is supported by critical activities. Taken together, the Entrepreneur Value Chain is the visual representation of the activities and characteristics that create a competitive advantage for entrepreneurial superstars.

Successful entrepreneurship begins with the entrepreneur and the venture interacting. A successful entrepreneur engages in certain activities – thinking productively, setting goals, managing time and tasks – and exhibits specific characteristics that support these activities – integrity, reflection and a strong support network.

Once the entrepreneur identifies a venture opportunity, we move to the venture side of the Entrepreneur Value Chain. Here, there are certain necessary activities – validating a problem, solution, and customers, developing a team, creating a sales plan – and specific characteristics that support these activities – the company culture, an advisory board, and customer-focused communications.

What really excites me about the Entrepreneur Value Chain is the inclusion of some fundamental building blocks of entrepreneurship. These cut across the individual and the venture cycles, from before the opportunity jumps out until the business scales.

Successful entrepreneurship begins with the entrepreneur and the venture interacting. A successful entrepreneur engages in certain activities – thinking productively, setting goals, managing time and tasks – and exhibits specific characteristics that support these activities – integrity, reflection and a strong support network.

Once the entrepreneur identifies a venture opportunity, we move to the venture side of the Entrepreneur Value Chain. Here, there are certain necessary activities – validating a problem, solution, and customers, developing a team, creating a sales plan – and specific characteristics that support these activities – the company culture, an advisory board, and customer-focused communications.

What really excites me about the Entrepreneur Value Chain is the inclusion of some fundamental building blocks of entrepreneurship. These cut across the individual and the venture cycles, from before the opportunity jumps out until the business scales.

- Continuous Action

- A Burning Desire to Succeed

- Creative Energy

Women and Minority-Owned Business Resources - Author: Tom Shaw

Women and minorities are increasingly starting their own businesses. Studies show that within the next decade, the majority of entrepreneurs will be women and minorities. Many resources are available that will help ensure new businesses not only have a good start, but also the best chance at success. It isn't enough to have a great business plan and finances, but there must be resources in place to reduce risk of business failure. There are federal, state, and local organizations that provide resources for women and minority entrepreneurs.

Women

- National Women's Business Council: Find resources, information, and initiatives with this federal advisory council geared to promote female entrepreneurs.

- Global Investher: Find financial resources, ideas, and inspiration for female entrepreneurs by networking with successful, professional women.

- U.S. Women's Chamber of Commerce: Find your local chapter of the U.S. Women's Chamber of Commerce and connect to resources in your area.

- National Association of Women Business Owners: NAWBO provides resources, tools, and tips for female entrepreneurs whether they are just starting out or are established business owners.

- Ladies who Launch: Find resources for female entrepreneurs and learn how to grow your business through networking.

- Black Business Association: African American entrepreneurs may find resources with the Black Business Association (BBA) that helps promote minority owned businesses.

- Office of Indian Energy and Economic Development (IEED): Find federal resources, grants, and funding for Native American entrepreneurs who need help establishing successful businesses.

- REI Native American Business Centers: REI provides financial assistance, training, and counseling to Native American entrepreneurs.

- United States Hispanic Chamber of Commerce: Hispanic entrepreneurs may connect with their local chapter of the United States Hispanic Chamber of Commerce to find resources, funding, grants, and more to promote business success.

- Latin Business Association: The Latin Business Association provides information to the public and members that help build strong and productive Hispanic-owned businesses.

- Asian Business Association: The Asian Business Association provides networking and resources for Asian American entrepreneurs.

- Americans for Indian Opportunity: Native Americans may network and access professional resources through the various projects offered by the AIO.

- SME Toolkit Asian-Owned Businesses: Find advice and professional tools for Asian entrepreneurs as well as other minority groups with the SME Toolkit.

- US Pan Asian American Chamber of Commerce Education Foundation: Find resources, tools, and programs for Asian Americans in business.

- The National Minority Business Council: Find resources, programs, and tools to assist minorities in the business sector.

- National Minority Supplier Development Council: Become certified as a minority business and tap into resources geared toward African American, Asian, Native American, and Hispanic entrepreneurs.

- Minority Business Development Agency: Find resources, information, and apply for grants and loans at the U.S. Department of Commerce's minority business division.

- National Conference of State Legislatures: Find links to each state's minority business enterprise (MBE) certification to ensure minority-owned businesses meet federal standards before applying for loans, grants, and financial aid.

- Small Business Resource Guide: Discover available resources provided by the Department of Housing and Urban Development that assist minorities in business success.

- Code of Federal Regulations Business Credit Assistance: Learn about Title 13, Business Credit and Assistance federal codes and rules that govern the rules of eligibility.

- SBA 8(a) Business Development Program: The Small Business Administration offers the 8 (a) Business Development Program that assists minorities and women business owners.

- Business USA: Access resources, information, and tools from the United States government to help minorities and women grow their businesses.

- Minority Entrepreneurs: Find statistics, information, resources, and tools for minority entrepreneurs and small businesses.

- USDA Minority Farm Register: Minority farm owners may access resources, tools, and services through the United States Department of Agriculture's Farm Service Area.

- United States Department of Transportation Small Business: Minority small business owners will find financial assistance and tools to ensure they are competitive in their fields.

- Amber Grant: Geared towards women entrepreneurs, the Amber Foundation Grant helps ensure women have access to start-up funds for their businesses.

- Grants: Find open grant opportunities for minorities in business.

- American Association of University Women: The AAUW provides grants and funding to graduate women.

- Eileen Fisher Grant Program: Eileen Fisher grants are awarded to women entrepreneurs who own their businesses.

- NAACP Grants: African American business owners may apply for loans and grants with the NAACP.

- Alabama Department of Economic and Community Affairs: The Office of Minority Business Enterprises provides resources for women and minority entrepreneurs in Alabama.

- Department of Administrative Services: Minority business owners in Connecticut may find information regarding available state programs.

- Minority Business Enterprise Center: Those in Washington, D.C. may access resources, tools, and programs

- Office of Supplier Diversity: Florida business owners will find tools for certification, events, resources, and other tools for women and minority entrepreneurs.

- Mississippi Development Authority: Entrepreneurs in Mississippi can access programs, information, and tools geared towards minority entrepreneurs.

- Division of Minority and Women's Business Development: New York entrepreneurs may find resources, certification, and empowering tools at the DMWBD.

- Development Services Agency: The Minority Business Enterprise Division of Ohio provides certification, tools, and support to help participant's success.

- Office of Minority, Women, and Emerging Small Business: OMWESB provides resources, ideas, and tools for business success for minority and women entrepreneurs in Oregon.

- Disadvantaged Business Enterprise Program: The Vermont Agency of Transportation offers programs through their civil rights division to ensure women and minority business owners have the same access to economic resources.

- Washington State Office of Minority and Women's Business Enterprises: Women and minorities in the state of Washington will find small business resources, opportunities, programs, and certification.

- Minority Entrepreneurs: SCORE provides resources, training, and assistance to minority business owners.

- The Solution That Could Help Minority Entrepreneurs Get Funding: FORBES examines several issues that face minority business owners and shows how New Orleans is addressing the challenge.

- Where America's Minority Entrepreneurs Are: According to this study, Florida leads the nation with minority-owned businesses.

- Minority Entrepreneurs Discriminated Against for Loans: Study shows discrimination continues when minority entrepreneurs apply for small business loans.

- Where Older Entrepreneurs can find Help: The Wall Street Journal addresses the issues and concerns of baby boomers and older entrepreneurs who branch out.